Breaking News Alert

issued for ZYCI - August 14th, 2012 |

- Last Trade: $

- Change:

- Open: $

- High: $

- Low: $

- Volume:

| Company Snapshot |

Ziyang Ceramics Corporation

US Office:

431 Fairway Drive

Suite 261

Deerfield Beach, FL 33441

China Office Corporate Address:

Xi Lv Biao Industrial Park

Longdu Street

Zhucheng City, Shandong Province,

China 262200

www.ziyangcorp.com U.S. Representative:

Pearl Group Advisors

Dore Perler

Tel: (954) 232-5363

Email: Dore@PearlGroupAdvisors.com

Sector: Building Materials

Ticker Symbol: ZYCI

Exchange: OTCBB

Market Value: $23.3Mil

Shares Outstanding: 10,001,220

Float: APX 356,406

|

| Social Network Connections |

|

Ziyang Ceramics Reports Financial Results for the Second Quarter Ended June

30, 2012

Zhucheng, China--(8/14/2012) – Ziyang Ceramics

Corporation (OTC.BB: ZYCI), a leading

manufacturer of high quality interior porcelain

tiles in China, announced today its financial

results for the second quarter ended June 30,

2012.

- Second quarter 2012 revenue climbs to

$14.4 million, up 45.6% from revenue of $9.9

million recorded in the second quarter of

2011

- Second quarter 2012 net income

reaches $4.0 million, up 76.1% from $2.3

million recorded in the second quarter of

2011

- Gross margin climbs to 37.6% and net

margin reaches 27.8% in the second quarter

of 2012

- Basic and diluted EPS reached $0.82

for the first six months of 2012 on 9

million weighted average shares outstanding

Financial Highlights

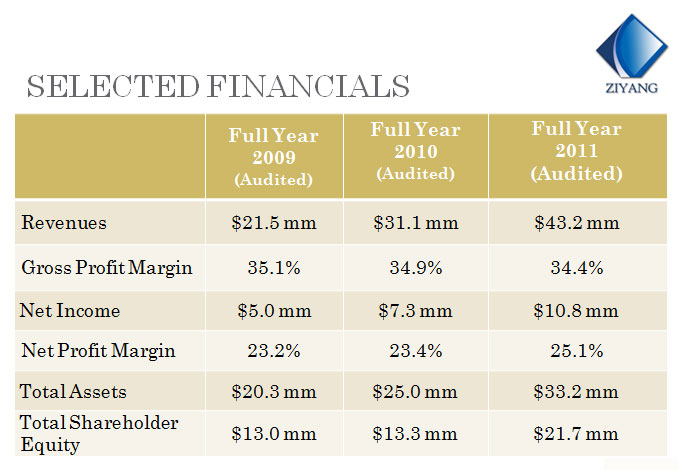

For the second quarter of 2012, total

revenues reached $14.4 million, up 45.6% from

$9.9 million recorded in the second quarter of

2011. The increase in revenue was primarily

driven by the increase in sales from our new

line of interior porcelain wall tiles launched

in August of 2011. Gross profit in the second

quarter of 2012 increased to $5.4 million, up by

54.8% from $3.5 million achieved in the second

quarter of 2011. Gross profit margin increased

to 37.6% in the second quarter of 2012, compared

to 35.4% in the same period of 2011 primarily

due to the higher sales of our premium

polycrystalline floor tiles where gross margin

reached 42%. Overall net margin in the second

quarter of 2012 increased to 27.8%, up from

23.0% recorded in the same period in 2011. Total

operating expenses for the second quarter of

2012 decreased to $531,000, down 13.4% from

$613,000 recorded in the same period in 2011.

The decrease in operating expenses is primarily

due to a reduction in retirement insurance

expense.

For the second quarter of 2012, net income

rose 76.1% to $4.0 million with earnings per

basic and diluted share of $0.40 on 10 million

weighted average shares outstanding. This

compares to net income of $2.3 million recorded

in the second quarter of 2011with earnings of

$3.83 per basic and diluted share on 590,000

weighted average shares outstanding. The

increase in the number of common shares

outstanding in 2012 is a result of the issuance

of 8.9 million shares in May of 2012 upon full

conversion of two outstanding promissory notes

we issued in connection with our acquisition of

Ziyang Ceramic Company.

For the first six months, total revenues

reached $25.8 million, up 48.6% from $17.3

million recorded in the same period in 2011. Net

income for the first six months totaled $7.1

million, an increase of 78.7% from $4.0 million

recorded for the six month period in 2011. We

recorded earnings per basic and diluted share of

$0.82 for the first six months of 2012 on 9

million weighted average shares outstanding.

At June 30, 2012, total cash was $5.8 million

after the payment of $5.1 million in long term

prepaid rent for 24 acres of land we plan to use

for additional facility expansion and the

repayment of approximately $2.6 million in loans

outstanding. This compares to cash and cash

equivalents of $5.9 million at December 31,

2011. Current assets were $14.2 million at June

30, 2012 compared to current assets of $14.1

million at December 31, 2011. Total shareholder

equity increased by 33.5% to $29.0 million,

compared to shareholder equity of $21.7 million

at December 31, 2011.

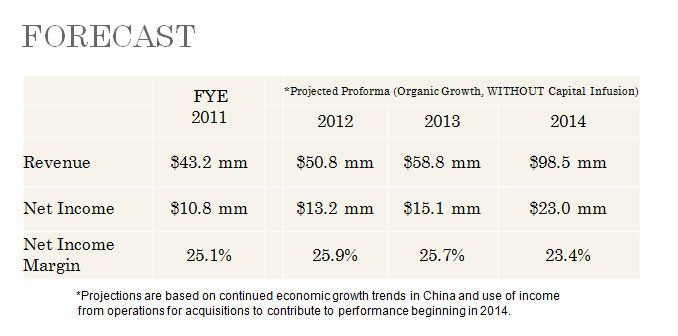

Commenting on the financial results for the

second quarter and six months of 2012, Mr.

Lingbo Chi, CEO of Ziyang Ceramics, stated, "We

are extremely pleased with our performance this

quarter as we continue to meet or exceed our

sales targets while increasing margins and

controlling expenses. We have further

strengthened our distribution base in the second

quarter as our interior and higher-end tiles

continue to be well received in our end markets.

We are confident in our ability to build on our

strong performance in the first half of 2012 and

we believe our investments for the future for

facility expansion will enable us to expand for

the foreseeable future as we look to

opportunistically grow our business. We continue

to see our full year 2012 revenue exceeding $55

million with $14 million in net income. Our

entire team is working diligently to further our

growth in the coming quarters and years to help

us maximize the value of our company for the

benefit of our shareholders.”

Continued...

Read the entire Press Release & ZYCI's full

disclosures on YahooFINANCE.com

About Ziyang

Ceramics Corporation |

Founded

in 2006, Ziyang Ceramics Corp. ("Ziyang

Ceramics" or ZYCI) is a leading manufacturer of

high quality interior porcelain tiles in China

for use in residential and commercial

applications. ZYCI has built an extensive and

growing network of more than 150 distributors

targeting numerous major second and third tier

cities throughout 10 provinces in China. Ziyang

Ceramics sells s products under the three well

established brand names of "FuYunDe", "Luckway"

and "GEF". The Company also provides private

label products to large distributors who market

these products under their own brand names. Founded

in 2006, Ziyang Ceramics Corp. ("Ziyang

Ceramics" or ZYCI) is a leading manufacturer of

high quality interior porcelain tiles in China

for use in residential and commercial

applications. ZYCI has built an extensive and

growing network of more than 150 distributors

targeting numerous major second and third tier

cities throughout 10 provinces in China. Ziyang

Ceramics sells s products under the three well

established brand names of "FuYunDe", "Luckway"

and "GEF". The Company also provides private

label products to large distributors who market

these products under their own brand names.

Today, Ziyang Ceramics operates a 775,000 square

foot production facility with an annual

production capacity of approximately 18 million

square meters located in the city of Zhucheng in

Shandong province, on the central eastern coast

of China. ZYCI's state of the art facility runs

multiple production lines to produce an exciting

spectrum of porcelain tile selections in three

main product categories with more than 50

different size and color combinations to choose

from. During the production process we increase

efficiency and reduce environmental impact by

recovering and reusing waste water, waste gas,

and waste dust.

- Leading porcelain tile producer in China

with Vast sales and distribution network &

High growth potential

- 3 fully automated production lines with

annual output of over 200 million sq.ft. of

tiles

- Owns mining rights to 6 local mines with

estimated reserves of approximately

21million tons of white clay raw material

- Loyal customer base and a strong sales

network - Top 10 distributors account for

54% of sales and have purchased from us for

over four years

- End customers include commercial and

residential developers for malls, banks,

government buildings, high-end residential

apartments, and rural dwellers

- Received the Green Building Ceramics

Recommended Certification of China from

China Building Ceramic and Sanitary Ware

Association

Why Consider

Ziyang Ceramics Corporation Today - Investment Considerations |

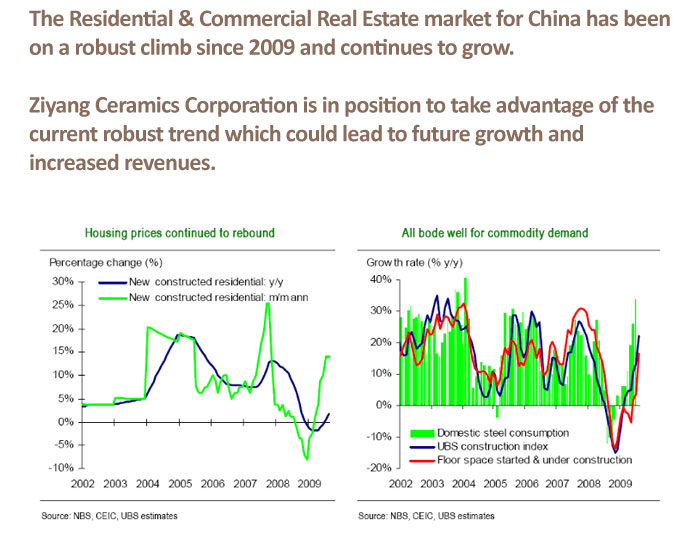

The sheer size of China’s housing market offers

opportunity for Ziyang to grow even if home

prices drop. According to analysts at i nternational

property consultancy Knight Frank, “China has

the world’s largest housing market, and

investors—both foreign and local—has immense

interest in this thriving sector. In 2011, an

estimated 9.6 million new homes were sold across

mainland China. The real estate sector accounted

for 20.4% of China’s RMB30.2-trillion fixed

asset investments last year. nternational

property consultancy Knight Frank, “China has

the world’s largest housing market, and

investors—both foreign and local—has immense

interest in this thriving sector. In 2011, an

estimated 9.6 million new homes were sold across

mainland China. The real estate sector accounted

for 20.4% of China’s RMB30.2-trillion fixed

asset investments last year.China’s

residential real estate market has been one of

the best performing markets in the world, with a

five-year price appreciation of 110.9% through

December 31, 2011.

In the largest first tier cities, including

Beijing, Shanghai, and Shangdong, the coastal

city that’s experiencing accelerated growth both

in its economy and population, and consequently

serving as Ziyang’s headquarters and

manufacturing facility, the cost of a home in

the most desirable neighborhoods have reached

levels that make them inaccessible to all but a

privileged few.

Ziyang Ceramics is well positioned to benefit

from accelerated growth both in China's economy

and population. The company could also improve

on its profit margins as it now owns licensure

to mine resources, providing low cost access to

raw materials, and a well-established

distribution network to move the final product

to market. Based on general market trends for

residential real estate construction in China,

Ziyang to is expected to continue growing.

Ziyang Ceramics carries very

little long-term debt relative to the size of

the company’s earnings, reporting current

liabilities at just $9.7 million. Compared with

Ziyang’s total assets account of more than $34

million, the company is in a unique position to

take advantage of China’s record low interest

rates to ramp up production should they choose

to in the future.

The stock of Ziyang Ceramics is undervalued by

fundamental measures in the market. Based on the

company’s SEC filings, earnings have totaled

more than $12.3 million in the past 12 months.

Recent Ziyang

Ceramics Corporation News Releases and Filings |

Ziyang Ceramics Signs Ten New OEM Distribution

Agreements in the Second Quarter of 2012

Collectively Requiring Minimum Sales of $1.3

Million per Month

Bullworthy, LLC Initiates Coverage on Ziyang

Ceramics Corporation With Detailed Research

Report

Ziyang Ceramics Reports Financial Results for

the First Quarter Ended March 31, 2012

Ziyang Ceramics Reports Financial Results for

the Year Ended December 31, 2011

Ziyang Ceramics CEO Releases Letter to

Shareholders

Form 8-K for ZIYANG CERAMICS CORP

ZIYANG CERAMICS CORP Financials

FN Media Group LLC (FNMG) owns and operates

FinancialNewsMedia.com (FNM) which disseminates

electronic information through multiple online

media channels. FNMG's intended purposes are to

deliver market updates and news alerts issued

from private and publicly trading companies as

well as providing coverage and increased

awareness for companies that issue press to the

public via online newswires. FNMG and its

affiliated companies are a news dissemination

and financial marketing solutions provider and

are NOT a registered

broker/dealer/analyst/adviser, holds no

investment licenses and may NOT sell, offer to

sell or offer to buy any security. FNMG's market

updates, news alerts and corporate profiles are

NOT a solicitation or recommendation to buy,

sell or hold securities. An offer to buy or sell

can be made only with accompanying disclosure

documents from the company offering or selling

securities and only in the states and provinces

for which they are approved. The material in

this release is intended to be strictly

informational and is NEVER to be construed or

interpreted as research material. All readers

are strongly urged to perform research and due

diligence on their own and consult a licensed

financial professional before considering any

level of investing in stocks. The companies that

are discussed in this release may or may not

have approved the statements made in this

release. Information in this release is derived

from a variety of sources that may or may not

include the referenced company's publicly

disseminated information. The accuracy or

completeness of the information is not warranted

and is only as reliable as the sources from

which it was obtained. While this information is

believed to be reliable, such reliability cannot

be guaranteed. FNMG disclaims any and all

liability as to the completeness or accuracy of

the information contained and any omissions of

material fact in this release. This release may

contain technical inaccuracies or typographical

errors. It is strongly recommended that any

purchase or sale decision be discussed with a

financial adviser, or a broker-dealer, or a

member of any financial regulatory bodies.

Investment in the securities of the companies

discussed in this release is highly speculative

and carries a high degree of risk. FNMG is not

liable for any investment decisions by its

readers or subscribers. Investors are cautioned

that they may lose all or a portion of their

investment when investing in stocks.

This release is not without bias, and is

considered a conflict of interest if

compensation has been received by FNMG for its

dissemination. To comply with Section 17(b) of

the Securities Act of 1933, FNMG shall always

disclose any compensation it has received, or

expects to receive in the future, for the

dissemination of the information found herein on

behalf of one or more of the companies mentioned

in this release. For current services performed

for Ziyang Ceramics Corporation (OTCBB: ZYCI),

FNMG expects to be compensated five thousand

dollars by a non-affiliated third party which

may hold shares in ZYCI, for news dissemination

services & outreach coverage. FNMG HOLDS NO

SHARES OF Ziyang Ceramics Corporation (OTCBB:

ZYCI).

This release contains "forward-looking

statements" within the meaning of Section 27A of

the Securities Act of 1933, as amended, and

Section 21E the Securities Exchange Act of 1934,

as amended and such forward-looking statements

are made pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act

of 1995. "Forward-looking statements" describe

future expectations, plans, results, or

strategies and are generally preceded by words

such as "may", "future", "plan" or "planned",

"will" or "should", "expected," "anticipates",

"draft", "eventually" or "projected". You are

cautioned that such statements are subject to a

multitude of risks and uncertainties that could

cause future circumstances, events, or results

to differ materially from those projected in the

forward-looking statements, including the risks

that actual results may differ materially from

those projected in the forward-looking

statements as a result of various factors, and

other risks identified in a company's annual

report on Form 10-K or 10-KSB and other filings

made by such company with the Securities and

Exchange Commission. You should consider these

factors in evaluating the forward-looking

statements included herein, and not place undue

reliance on such statements. The forward-looking

statements in this release are made as of the

date hereof and FNMG undertakes no obligation to

update such statements.

|